Consumer subscriptions are bleeding money

Subscriptions aren't capturing value, they're hemorrhaging it through a hidden cost: the trust tax.

Author note: I meant to publish this post a lot sooner, thanks for your patience while I learn how to be disciplined about writing.

A few weeks ago, I wrote about the idea of the trust premium, which is the thing that in theory makes subscription a very powerful business model for consumer software.

The trust premium in a nutshell: Real leverage in subscription doesn’t just come from getting someone to pay you over and over—it comes from doing so meaningfully and sustainably below the cost of customer acquisition. This is what makes subscription greater than the sum of its recurring payments.

Unfortunately, most subscription businesses don’t actually capture a trust premium. Instead, almost all pay a trust tax. This is because, in the pursuit of maximizing LTV:CAC, businesses have unwittingly taught customers to completely and totally hate subscribing. They do this through zombie subscriptions.

Zombie subscriptions are what happens when businesses believe that the best way to make money is to auto-bill customers until they cancel. I think this is completely wrong, and I’d like to make an economic argument for why this is.

Zombie billing is toxic to subscriber economics

Here's a thought experiment: Have you ever checked your credit card statement and noticed you've been paying $7.99 a month for the past year for some random subscription you signed up for and completely forgot about?

When you see an interesting new service and you get hit with a "Subscribe Now" CTA do you think to yourself, "oh how convenient, I don't need to keep remembering to buy this?" Or do you think something different?

Zombie billing, or the potential to get quietly auto-billed for dormant or underused subscriptions, is one of those things that people in subscription land have accepted as an unfortunate conflict of business and customer interests. But this issue might in fact be what keeps most consumer subscriptions treading water.

What does it take to get someone to subscribe?

This paper from Miller et al investigates the phenomenon of zombie subscriptions, (which they politely call subscriber inertia) and its effects on subscription revenue.

In their experiment with a large digital news publisher, they gave readers different intro offers varying these dimensions: term length (2 or 4 weeks), price (free or $1), and whether that trial automatically renewed to a subscription (auto-renew or auto-cancel). Then they observed what happened to those readers over the course of 2 years.

This study is a goldmine and I’m sure I will write about it again and again, but here are some of the most insane findings.

What they found

Of the three dimensions tested, only one actually made a difference: renewal policy.

Most people are aware of their tendency to sign up for and later forget about a subscription (58-67% of readers are “sophisticated” about inertia)

This awareness makes them actively avoid subscribing when it’s the only option offered (24-36% fewer subscribers)

When readers have the choice to opt-in instead of automatically renewing, businesses end up making the same amount of money from more subscribers

It’s worth noting— reducing the price of the trial offer from $1 to $0 and extending the trial term length from 2 weeks to 4 weeks made a difference in terms of trial signups and short-term revenue, but did not meaningfully improve paid subscriber growth or real long-term revenue.

Why does this matter?

These findings directly contradict a lot of conventional wisdom in subscription growth, namely:

You have to lower the price to get more subscribers

Free and long trials help paid conversion

Companies should mainly focus on maximizing LTV from existing subscribers

The best way to maximize LTV:CAC is to make subscribers stick around forever

Instead, it starts to quantify the biggest issue that is dragging subscriber economics down— we’ve made subscribing so painful that almost no one wants to do it.

What if growing a consumer subscription is hard because subscribing isn’t a good deal for most potential customers and they know it?

What is the Trust Tax?

I believe most consumer subscriptions don't capture a trust premium and instead pay a trust tax. What does this actually mean? It comes back to LTV:CAC.

In an earlier post, I wrote that consumer software serves what I call "whale markets"—oceans of potential customers. Unlike enterprise software, where 40% of revenue can come from the top 1% of customers, in consumer software the potential LTV of any individual subscriber is much lower and the distribution much flatter. In other words, there is no $100M Netflix subscriber. So while maximizing LTV is generally sound advice for improving subscriber economics, in consumer it's sometimes like trying to squeeze more juice from an already well-wrung orange. The trust tax is an unintended consequence of squeezing too hard.

The Trust Tax shows up in your CAC, not LTV

Acquisition costs in consumer software—while lower than in enterprise—face an invisible psychological inflation that few businesses properly account for. This is the trust tax.

This psychological drag doesn't show up in LTV calculations. It manifests in the steadily increasing cost of convincing the next person to subscribe—a hidden tax on CAC that grows more punitive with each scaling attempt.

Every sneaky billing practice, every buried "cancel" button, every customer who discovers they've been paying for months for something they don't use—these aren't just customer experience problems. They're serious barriers to continued growth, a negative externality that no amount of product or onboarding improvements can overcome.

When almost everyone has had a negative experience with subscribing, that collective wariness becomes a tax on acquiring subscribers—one that grows as you try to scale.

Because of the Trust Tax, LTV:CAC stays the same or gets worse.

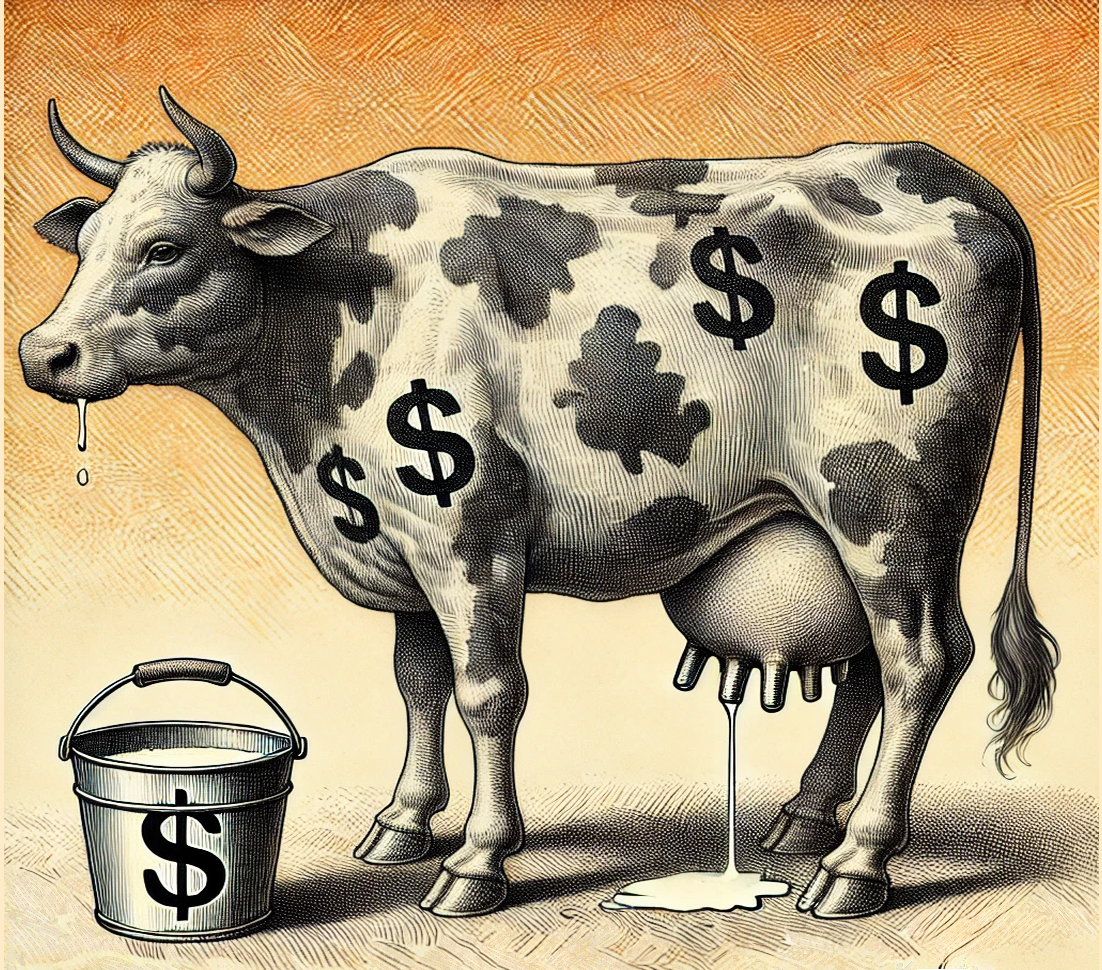

Modern subscription isn’t a cash cow,

it’s a money pit. What comes next?

AI is already bringing us so many cool new consumer internet startups. It would be a huge mistake to try and grow them with our current business models.

There is a whole universe of more flexible, customer-aligned approaches to monetization waiting to be explored. Approaches that align business and customer interests instead of pitting them against each other. Approaches that leverage the economic value of trust—which, like reputation, takes years to build and seconds to destroy.

In future essays, I'll explore some of the design principles that could guide this new wave of the internet economy. In the meantime, here’s something I’m reflecting on:

When the number of potential customers vastly exceeds their individual value, the counterintuitive path to growth isn't extracting more revenue from each subscriber, it’s reducing the psychological cost of saying "yes" in the first place.

Thanks for reading

If you loved it, hated it, or have questions, sound off in the comments.

My company, Lightswitch, is taking on new clients. If you’re a consumer software founder who is interested in working with the pricing team of the future please reach out hello@getlightswitch.com.

Want to read more? Share and subscribe.

There is a generation of entrepreneurs from an earlier era who were taught that breakage, or zombie subscriptions, was a feature and not a bug when it comes to subscriptions. They made it really hard to cancel or get out of subscriptions as a business tactic, knowing full well that this was hostile to the customer. As you point out, they could have done much better with a less antagonistic approach and they conditioned customers to be skeptical of the motivations of companies offering subscriptions.