Enterprise Software is Fat-Tailed. What About Consumer?

What will it take for consumer software businesses to make venture-scale money? A radically different philosophy on monetization.

Enterprise Software is for Whale Hunting

I find this essay about enterprise software monetization so insightful and I encourage everyone to read it.

TL;DR

In enterprise, metrics like average revenue per customer are a poor proxy for understanding true revenue potential; the former usually underestimates the latter

This is because customers differ in their willingness to pay for a service, and these differences can be very large (Nnamdi makes his case using concepts like skewness, fat-tails, Nassim Taleb, etc., but this is the gist)

Scalable monetization strategies, e.g. usage-based pricing, help businesses maximize revenue capture

This is because scalability both lowers barriers to monetization and captures upside from customers with very high WTP, i.e. whales

Therefore, software businesses should take a “more is more” approach to customer acquisition, where lowering barriers to monetization improves the odds of catching a whale

Nnamdi’s essay defines the shape of the enterprise software market as one for whale-hunting— where a fat-tailed distribution means very few customers generate the majority of revenue. But is the market for consumer software and services (CSS) the same shape? Not remotely.

Consumer Software and Services (CSS) is the Biggest Long-Tailed Market on Earth

If you were to take Nnamdi's approach of inferring potential customer demand using current customers and apply it to a consumer subscription business like Netflix, here's what you'd find:

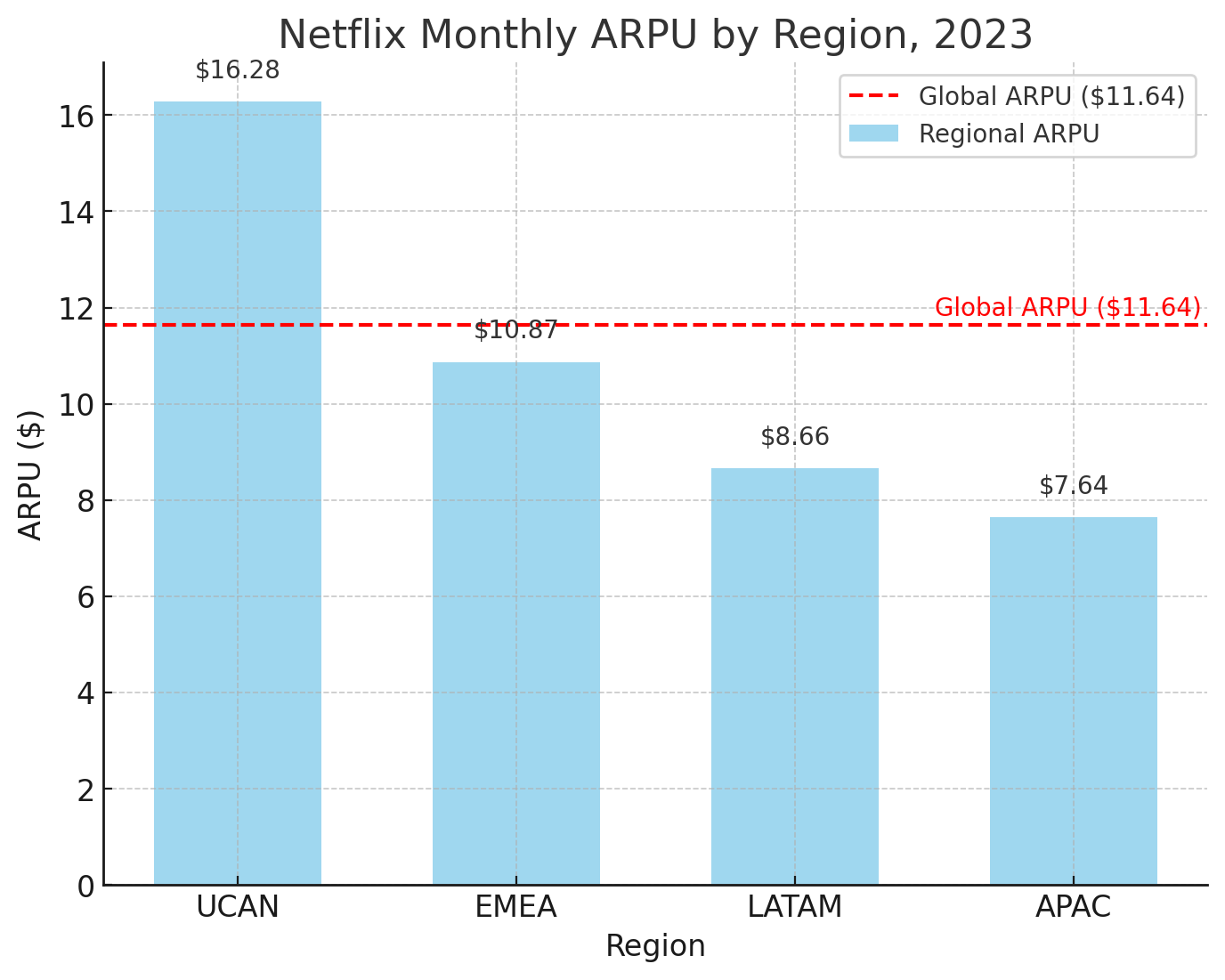

1. No fat tails in monetization. The difference between Netflix’s highest and lowest paying customers is not that meaningful. Admittedly I am taking a big shortcut since I'm using regional monthly ARPU as a proxy for subscriber revenue distribution. But since Netflix's pricing is public, we know that the maximum monthly revenue they're getting from any one membership is around $39 (1 month of Premium + two extra users). This means we're looking at, at most, a 5x difference in monthly revenue between customers. This is not the 10-100x variance that would classify a fat-tailed distribution.

2. One product for hundreds of millions of customers. Netflix has hundreds of millions of subscribers and spends just 8% of revenue on marketing. Why? Because consumer software can reach hyper-scale with minimal personalization and almost no sales motion.

3. Revenue Growth Still Comes From Subscriber Growth, Not ARPU. Yes, Netflix raises prices in mature markets and has started selling ads. But real revenue growth continues to come from simply adding more subscribers, even lower ARPU subscribers. In Netflix’s market, more is always more.

In other words

Netflix is a $375B company, and it’s not because they nabbed a $100M subscriber. It’s because every month they catch hundreds of millions of $11 subscribers.

How Do You Catch Whales in Consumer?

The first step is understanding that there are no whale customers in consumer.

There are however, whale markets.

Many consumer subscription businesses struggle to grow because they apply enterprise thinking to consumer markets, trying to lock subscribers in and maximize their individual value. But there are no whale customers in consumer software.

Instead, there's something bigger: whale markets. Markets so vast that even small individual value becomes enormous in aggregate. The key to catching these whales isn't extracting more revenue per user—it's eliminating barriers to monetization.

And the biggest barrier? It's not price. It's trust.

We see consumer whales in non-subscription models such as gaming and fashion e-com (where majority of revenue often comes from <10% customers). I wonder if consumer subscription companies are missing a trick by not offering a way for those would-be whales to pay more for enhanced value? They usually offer 2-3 tiers, and we're seeing 10x pricing with the $200/mo o3 tier - but perhaps this is far less extreme than it could be?