The App Store Is Eating Consumer Software

AI is reinventing software. The App Store is taxing it to death.

A few weeks ago, Brian Balfour published a standout essay called "The Next Great Distribution Shift". It’s about how every dominant platform follows the same three-act playbook: Open → Grow → Close and Monetize. We’re living through the opening of a new one—AI—and he makes the case that OpenAI is the next App Store.

Brian’s essay is a must-read for anyone thinking about where AI distribution is heading. But the real problem isn’t what might happen two years from now, it's what's happening in the here and now of the AI application layer.

AI-coded and GPT-wrapper consumer apps are flooding the internet, and there's nowhere for them to go.

Well, there's one place: the App Store. And it’s quietly suffocating the wave of software that AI just made possible.

Consumer software has never been weirder, faster, or cheaper to build. The App Store is the dominant platform for selling it.

We’re in the middle of a supply shock. AI tools have made it radically easier to build nimble, clever, experimental products—net new experiences for creativity, learning, utilities, role play, and more. And all of them need distribution.

Where do consumer apps go? Right now, the answer is almost always: mobile.

Mobile gives you reach. It gives you monetization infrastructure. And it gives you customers who are trained to pay.

But it also gives you a tax. And not just any tax—a steep and non-optimizable one.

The App Store's Rigidity Stunts the Potential of AI Apps

The App Store takes a 15–30% commission on app revenue through purchases made in-app. That tax, which has held steady since the App Store was introduced in 2006, was painful but tolerable when apps were expensive to build, incurred few marginal costs, and retained users for years.

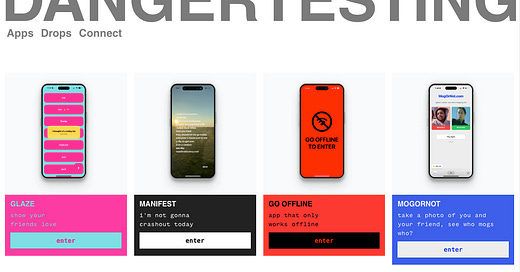

But AI has changed the supply chain. It enables a different shape of software: fast, experimental, abundant, ephemeral, disposable. Danger Testing is a great example of this new wave of AI-native apps.

Instead of adapting to that shift, the App Store is locking in its tax. Its economic model wasn’t designed to serve this new wave. And yet it controls the distribution rails anyway.

This isn’t just a pricing frustration; it’s a structural choke point.

Why? Because Form Follows Unit Economics

Form follows unit economics. In consumer software, the shape of a product (feature set, retention loops, even UI/UX) is increasingly dictated by its economic constraints—namely, the cost structure imposed by platforms like Apple.

If your cost of revenue demands high lifetime value, your product strategy will bend to match.

To offset the App Store tax, developers default to building products that fit only two business models: subscriptions and games. Products aren’t designed around the customer. They're designed to survive Apple’s commission.

The App Store, not customers, decides what's worth building.

We’re seeing an explosion of AI-native products made directly available to mainstream consumers who are willing to pay for them.

But with its rigid economic model, the App Store, not actual customers, makes most of these innovations commercially non-viable. This strikes me as super fucking unfair and idiotic. If you have any stake in consumer software, this should piss you off too. Every time a VC-backed founder launches their AI product as a mobile app, goes viral, and $15M later learns the unit economics still don’t make sense, the house gets paid first.

The App Store has calcified around an old model of consumer software: durable, feature-rich apps, recurring value, long-term retention. What will happen if everyone just uses AI to make millions of subscription apps?

AI-charged growth marketing doesn't change the math, it just raises the bar

App builders are getting better at viral growth, and fast. AI tools are improving ad creative, onboarding copy, paywalls, and targeting. But those advantages don't impact the core constraint in app distribution. In fact, it's reasonable to assume that as more builders adopt the same growth and conversion tactics, they might cancel each other out. The floor rises, but the ceiling stays fixed.

Platform tax is the one variable no builder can optimize. So while LTVs flatten and CAC rises, the contribution margin shrinks every cycle. The result? More apps, smarter marketing, worse economics.

Consumer software doesn't just need to worry about the future platform trap. It needs to break out of the current one.

Brian’s essay is right to flag what’s coming next, but most builders aren’t losing because they’re unprepared for the future App Store. They’re losing because they’ve already handed control over their margin, users, and business model to the current one.

AI doesn’t just change how we build software. It also changes the kind of software we can build. Unless this distribution channel decides to open up—or gets disrupted—we need to ask harder questions about where our apps live, how they grow, and who profits from them.

The next distribution shift might be coming. But the last one still hasn’t let go.

Thanks for reading

I’m working on a follow up to this essay that’s a little more practical for people who are actually building consumer apps. If this is you and you want to talk about it, please reach out!

My startup, Lightswitch, is also releasing some free tools next week for people who are building vibe coded apps and want to get started with monetization. Stay tuned :)